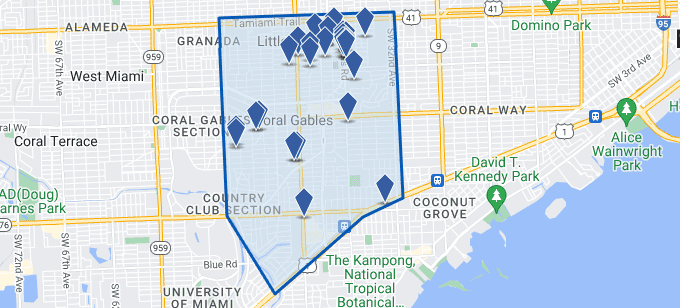

Property owners in Miami’s commercial market are facing a harsh reality. Rental rates are declining, leasing activity has slowed to a crawl, and the easy money days are over. This is particularly evident in Wynwood, where the retail market has shifted from red-hot to stone-cold in less than two years.

As a broker who’s closed deals through multiple market cycles in Miami’s top neighborhoods, I’m seeing owners make costly mistakes by clinging to pre-2023 rental expectations. The market has spoken. It’s time to adjust strategy or watch your properties sit vacant.

The Wynwood Retail Reality: Numbers Don’t Lie

Wynwood’s retail market tells the complete story of Miami’s current commercial leasing environment. Average asking rents have dropped 15-20% from their 2022 peaks, and properties that would lease within 30 days two years ago are now lingering on the market for six months or longer.

The neighborhood that once commanded $60-80 per square foot for prime retail space is now seeing deals close at $45-55 PSF. Ground-floor spaces along NW 2nd Avenue, previously the gold standard for retail visibility, are negotiating concessions that were unthinkable during the pandemic boom years.

Vacancy rates in Wynwood retail have climbed above 12%, nearly double what we saw in 2021-2022. The boutique galleries, trendy restaurants, and lifestyle brands that drove the district’s transformation are now being more selective about expansion plans and lease commitments.

Strategic Positioning in a Declining Rate Environment

Smart property owners are adapting their leasing strategies instead of fighting the market. The most successful landlords I’m working with have shifted from maximizing rent per square foot to maximizing total building income and tenant stability.

This means accepting lower base rents in exchange for stronger tenant covenants, longer lease terms, and strategic tenant mix improvements. A solid restaurant tenant at $40 PSF with a 10-year lease is worth more than a boutique at $60 PSF that might not survive the next economic downturn.

In Wynwood specifically, owners are finding success by targeting tenants who complement the neighborhood’s artistic identity while offering recession-resistant business models. Coffee shops, fitness concepts, and neighborhood service businesses are proving more reliable than pure retail play tenants.

The key is understanding that today’s market rewards landlords who can provide value beyond just space. Flexible lease terms, build-out allowances, and partnership approaches to tenant success are becoming standard negotiation points.

Investment Opportunities in the Correction

Declining rental rates create opportunities for strategic buyers, particularly in the $1-25 million range where DWNTWN Realty Advisors specializes. Current cap rates in Wynwood have expanded to 6-7% for quality assets, compared to the 4-5% compression we saw at market peak.

The buyers succeeding in this environment are those with either significant capital reserves for tenant improvements or extensive tenant relationships to fill spaces quickly.

Mixed-use buildings with ground-floor retail and upper-floor office or residential components are showing the most resilience. The diversified income streams help offset retail vacancy impacts while maintaining overall property performance.

For owner-users, this market presents exceptional opportunities to acquire retail space for business operations at discounts that won’t last forever. Manufacturing businesses, showrooms, and service companies can secure prime Wynwood locations at pricing that makes ownership more attractive than leasing.

Tenant Retention vs. New Leasing Strategy

The cost differential between retaining existing tenants and finding new ones has never been greater. Tenant improvements for new retail tenants in Wynwood are averaging $75-100 per square foot, while existing tenant renewals might require only minor concessions or modest improvement allowances.

Property owners need to get aggressive about renewal conversations 18-24 months before lease expiration. The tenants who survived the past two years have proven their business models work in challenging conditions. Losing them to chase higher rents from unproven prospects is a recipe for extended vacancy.

Smart renewal strategies include graduated rent increases over extended terms, percentage rent components tied to tenant success, and shared marketing or improvement costs that benefit both parties. The goal is creating partnerships that help tenants thrive while ensuring consistent cash flow for property owners.

Market Timing and Future Positioning

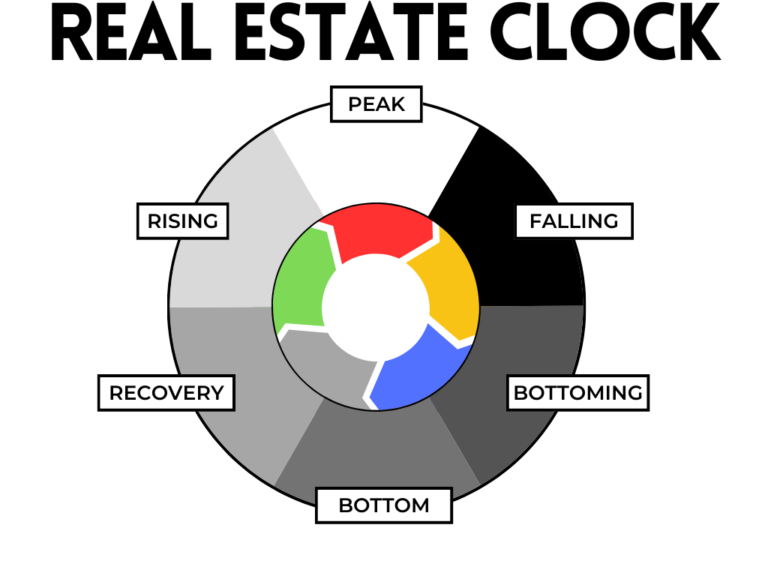

Miami’s commercial real estate market operates in cycles, and the current correction is setting up opportunities for the next expansion phase. Wynwood’s fundamentals remain strong despite current leasing challenges. The neighborhood’s infrastructure improvements, transit access, and cultural identity create long-term value that temporary rental rate declines can’t eliminate.

Property owners who maintain their assets and adapt their leasing strategies during this period will be positioned to capitalize when demand returns. The key is surviving the current environment without damaging long-term asset value through deferred maintenance or poor tenant selection.

New development in Wynwood has slowed significantly, which will help existing properties regain pricing power as the market stabilizes. The oversupply issues that contributed to current conditions are self-correcting as developers pause new projects.

Taking Action in Today’s Market

The commercial leasing environment isn’t going to improve overnight. Property owners who recognize this reality and adjust their strategies accordingly will outperform those waiting for a return to 2022 conditions.

Whether you’re managing existing assets, considering acquisitions, or evaluating disposition opportunities, the current market demands experienced guidance and realistic expectations. The deals getting done today require creative structuring and deep market knowledge.

I’d like to schedule a time to see if we can add value to your next real estate move.

For additional resources and market insights: https://linktr.ee/AndrewDixon79