The 2009-2012 real estate recession was influenced by multiple factors. Subprime mortgage lending led to high default rates. The Federal Reserve reported a 6% drop in home prices nationwide, with Florida experiencing a 30% decline. Commercial vacancy rates soared. Interest rates fluctuated, exacerbating financial instability and decreasing consumer confidence.

Causes related to subprime mortgages

Subprime mortgage lending significantly contributed to the 2009-2012 real estate recession. High-risk loans resulted in massive defaults. According to the Federal Reserve, Florida experienced a 30% drop in home prices. Commercial vacancy rates jumped, adding to economic strain.

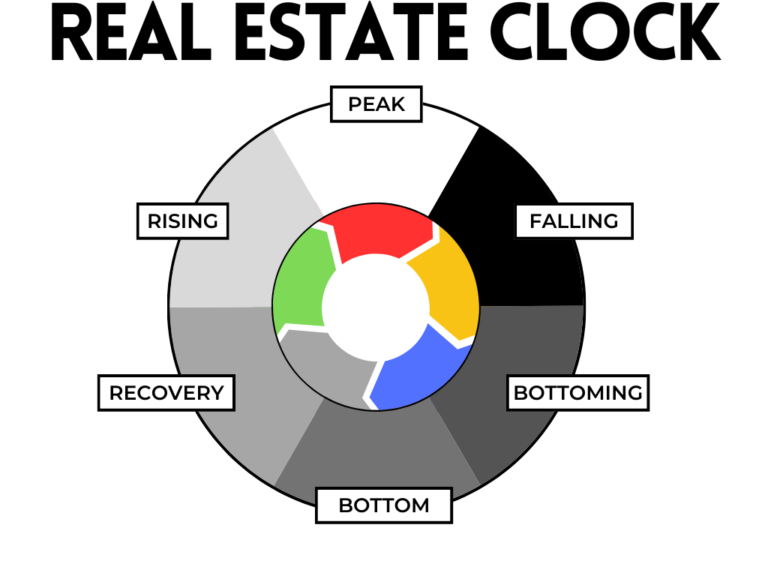

Florida’s real estate market experienced an unsustainable housing bubble. Rapid property value increases contributed significantly. According to Federal Reserve data, interest rates were initially low, fueling demand. Home prices surged by over 40% before plummeting, causing widespread economic distress. Subsequently, commercial vacancy rates exceeded 20%, exacerbating the downturn. These factors collectively destabilized Florida’s real estate sector. Additionally, high-interest rates exacerbated issues, making borrowing more costly and reducing investment in new properties.

Effects on construction and real estate industries

The downturn significantly hampered Florida’s construction sector. Housing starts plummeted by over 70% from their peak, as per Federal Reserve data. Job losses in construction exceeded 300,000 positions. Commercial real estate also faced challenges, with vacancy rates surging to 25%. High-interest rates further deterred investment, compounding the industry’s struggles.

Government Response and Interventions

The government launched housing stimulus programs to mitigate the crisis. The Federal Reserve’s reduction of interest rates aimed to stabilize the housing market. In Florida, these measures helped curb escalating foreclosure rates. Additionally, initiatives focused on refinancing underwater mortgages and stabilizing home prices, leading to a gradual recovery in commercial real estate and construction sectors.

The government introduced several housing stimulus programs to address the crisis in Florida. Notably, the Federal Reserve cut interest rates near zero, aiming to stimulate home buying and lower foreclosure rates. By cutting interest rates near zero, it aimed to stimulate new home purchases and lower foreclosure rates. The Federal Reserve’s actions led to a marked recovery in Florida’s real estate market. Home prices in the state saw a 20% stabilization by 2011. Commercial vacancy rates improved, dropping by 15%.

Lessons Learned

Florida’s experience during the 2009-2012 recession highlighted vital lessons. The Federal Reserve’s data on interest rates revealed that regulatory changes were crucial in averting future crises. Home prices, which plummeted by nearly 50%, led to stricter financing norms. Additionally, commercial vacancy rates showed a peak of 18%, emphasizing the need for effective risk management strategies in real estate.

TLDR

The 2009-2012 real estate recession delivered a profound impact on Florida’s economy. The Federal Reserve’s 3% rate hikes were crucial to curbing the downturn. Home prices plummeted by nearly 50%, while commercial vacancy rates reached 18%. These figures underscore the recession’s severity and the importance of robust economic policies and market adjustments for future stability.

Implications for future economic policies and market trends

The 2009-2012 recession highlighted the need for stringent regulatory frameworks. The Federal Reserve’s rate hikes proved crucial in mitigating systemic risks. Florida saw home prices fall by nearly 50%, with commercial vacancy rates peaking at 18%. Such data underscore the importance of effective policy measures to prevent future market instability and ensure economic resilience.

Certainly, here is your revised content in a format ready for pasting into WordPress:

The 2009-2012 real estate recession was influenced by multiple factors. Subprime mortgage lending led to high default rates. The Federal Reserve reported a 6% drop in home prices nationwide, with Florida experiencing a 30% decline. Commercial vacancy rates soared. Interest rates fluctuated, exacerbating financial instability and decreasing consumer confidence.

Causes related to subprime mortgages:

Subprime mortgage lending significantly contributed to the 2009-2012 real estate recession. High-risk loans resulted in massive defaults. According to the Federal Reserve, Florida experienced a 30% drop in home prices. Commercial vacancy rates jumped, adding to economic strain.

Florida’s real estate market experienced an unsustainable housing bubble. Rapid property value increases contributed significantly. According to Federal Reserve data, interest rates were initially low, fueling demand. Home prices surged by over 40% before plummeting, causing widespread economic distress. Subsequently, commercial vacancy rates exceeded 20%, exacerbating the downturn. These factors collectively destabilized Florida’s real estate sector. Additionally, high-interest rates exacerbated issues, making borrowing more costly and reducing investment in new properties.

Effects on construction and real estate industries:

The downturn significantly hampered Florida’s construction sector. Housing starts plummeted by over 70% from their peak, as per Federal Reserve data. Job losses in construction exceeded 300,000 positions. Commercial real estate also faced challenges, with vacancy rates surging to 25%. High-interest rates further deterred investment, compounding the industry’s struggles.

Government Response and Interventions:

The government launched housing stimulus programs to mitigate the crisis. The Federal Reserve’s reduction of interest rates aimed to stabilize the housing market. In Florida, these measures helped curb escalating foreclosure rates. Additionally, initiatives focused on refinancing underwater mortgages and stabilizing home prices, leading to a gradual recovery in commercial real estate and construction sectors.

Lessons Learned:

Florida’s experience during the 2009-2012 recession highlighted vital lessons. The Federal Reserve’s data on interest rates revealed that regulatory changes were crucial in averting future crises. Home prices, which plummeted by nearly 50%, led to stricter financing norms. Additionally, commercial vacancy rates showed a peak of 18%, emphasizing the need for effective risk management strategies in real estate.

TLDR:

The 2009-2012 real estate recession delivered a profound impact on Florida’s economy. The Federal Reserve’s 3% rate hikes were crucial to curbing the downturn. Home prices plummeted by nearly 50%, while commercial vacancy rates reached 18%. These figures underscore the recession’s severity and the importance of robust economic policies and market adjustments for future stability.

Implications for future economic policies and market trends:

The 2009-2012 recession highlighted the need for stringent regulatory frameworks. The Federal Reserve’s rate hikes proved crucial in mitigating systemic risks. Florida saw home prices fall by nearly 50%, with commercial vacancy rates peaking at 18%. Such data underscore the importance of effective policy measures to prevent future market instability and ensure economic resilience.

The 2009-2012 real estate recession was influenced by multiple factors. Subprime mortgage lending led to high default rates. The Federal Reserve reported a 6% drop in home prices nationwide, with Florida experiencing a 30% decline. Commercial vacancy rates soared. Interest rates fluctuated, exacerbating financial instability and decreasing consumer confidence.

Causes related to subprime mortgages:

Subprime mortgage lending significantly contributed to the 2009-2012 real estate recession. High-risk loans resulted in massive defaults. According to the Federal Reserve, Florida experienced a 30% drop in home prices. Commercial vacancy rates jumped, adding to economic strain.

Florida’s real estate market experienced an unsustainable housing bubble. Rapid property value increases contributed significantly. According to Federal Reserve data, interest rates were initially low, fueling demand. Home prices surged by over 40% before plummeting, causing widespread economic distress. Subsequently, commercial vacancy rates exceeded 20%, exacerbating the downturn. These factors collectively destabilized Florida’s real estate sector. Additionally, high-interest rates exacerbated issues, making borrowing more costly and reducing investment in new properties.

Effects on construction and real estate industries:

The downturn significantly hampered Florida’s construction sector. Housing starts plummeted by over 70% from their peak, as per Federal Reserve data. Job losses in construction exceeded 300,000 positions. Commercial real estate also faced challenges, with vacancy rates surging to 25%. High-interest rates further deterred investment, compounding the industry’s struggles.

Government Response and Interventions:

The government launched housing stimulus programs to mitigate the crisis. The Federal Reserve’s reduction of interest rates aimed to stabilize the housing market. In Florida, these measures helped curb escalating foreclosure rates. Additionally, initiatives focused on refinancing underwater mortgages and stabilizing home prices, leading to a gradual recovery in commercial real estate and construction sectors.

Lessons Learned:

Florida’s experience during the 2009-2012 recession highlighted vital lessons. The Federal Reserve’s data on interest rates revealed that regulatory changes were crucial in averting future crises. Home prices, which plummeted by nearly 50%, led to stricter financing norms. Additionally, commercial vacancy rates showed a peak of 18%, emphasizing the need for effective risk management strategies in real estate.

TLDR

The 2009-2012 real estate recession delivered a profound impact on Florida’s economy. The Federal Reserve’s 3% rate hikes were crucial to curbing the downturn. Home prices plummeted by nearly 50%, while commercial vacancy rates reached 18%. These figures underscore the recession’s severity and the importance of robust economic policies and market adjustments for future stability.

Implications for future economic policies and market trends:

The 2009-2012 recession highlighted the need for stringent regulatory frameworks. The Federal Reserve’s rate hikes proved crucial in mitigating systemic risks. Florida saw home prices fall by nearly 50%, with commercial vacancy rates peaking at 18%. Such data underscore the importance of effective policy measures to prevent future market instability and ensure economic resilience.